By HarlemGuy

We’re been covering Harlem Real Estate for years. And the news just keeps getting better. This week the NY Post shows Harlem Real Estate some more love. The article was fantastic. Below is a reprint.

Live & learn

By MAX GROSS

NYPost

September 9, 2010

Don’t bet against Harlem.

At least, that’s what some buyers and developers believe.

The Harlem real estate market is about weighing risk (too much inventory, prices that were inflated) and reward (luxury housing stock in an affordable neighborhood). And while nobody knows which way the market’s headed, a number of buyers and developers have decided now is the time to gamble.

“I don’t care what the value is going to be like in two years,” says Hallie Leighton, who just bought a $650,000 two-bedroom condo in the Lore, a new building on West 112th Street, with the help Ellen Kapit of Sotheby’s and Norman Horowitz of Halstead Property.

Leighton ignored the snarky message-board posts on Streeteasy.com and that some buyers were allowed out of their contracts because Lore hadn’t completed construction on time.

“I’m not looking to sell,” she says. “I don’t care if it loses value [now]. In 30 years, the value of this property is going to go up . . . The neighborhood has too many natural pluses; there are two parks, proximity to the subway. I find it very unlikely it will go down.”

And she hasn’t been the only one.

“I think it was the perfect time to buy,” says Jo-Nell Labbienti, a lawyer in Colorado who, with her husband, Jim, also closed on a two-bedroom at the Lore as an investment property late last month — even after she was allowed to rescind her contract this January.

She asked for an extra $10,000 off the purchase price of $625,000 — which she got.

“If we didn’t hit the bottom, it was so close to the bottom that it didn’t make any difference,” Labbienti says.

The Labbientis, who worked with Halstead Property broker Jeff Goodman on the deal, also have an apartment on West 137th Street — and they haven’t had problems finding tenants.

It’s no wonder that buyers are still willing to bet on Harlem — prices, by Manhattan standards, are low. It’s fairly easy to find new construction in the $500 to $600 per square foot range, or less. Two recent examples: the Madera condo and the Odell Clark Place Condos, with prices in the low- to mid-$500 per square foot range.

Sam McCash and his wife, Sarah, who are about to close on a 1,470-square-foot two-bedroom condo at the new PS90 building, a conversion of a former elementary school on West 148th Street, scored an even better deal: They are paying around $480 per square foot.

“It made us feel really nice seeing trees outside our window,” McCash says. He adds that they looked at some cheaper units, but public transportation helped seal the deal. “Some of [the other buildings] were really nice — but very remote.”

The 75-unit PS90, which should start closings this month, is about 50 percent sold. (The building is mostly one- and two-bedrooms, with a 1,228-square-foot one-bedroom unit on the market for $585,000 and a 1,312-square-foot two-bedroom for $775,000.)

“When we came out with pricing, it was much more reasonable than it would have been a year before,” says Ron Moelis, CEO of L+M Development Partners, which built PS90.

And the numbers have been improving. According to appraisal firm Miller Samuel, the average price per square foot of co-ops or condos in Harlem and East Harlem jumped from an average of $570 per square foot in the first quarter of 2010 to $742 in the second quarter. Moreover, the number of sales improved by 18 percent. (Both numbers, however, are still well off their 2007 peaks, when the price per square foot was $836 in the fourth quarter, and 160 units closed in the third quarter — more than double the current traffic.)

Not every Harlem building is setting itself up as affordable. The 116-unit 1280 Fifth Ave. condo on Central Park North — with a Robert A.M. Stern-designed exterior and interiors by Andre Kikoski (who recently designed the Wright restaurant at the Guggenheim Museum) — is coming out of the gate this fall with an average price per square foot of $1,265. An 800-square-foot studio starts at $725,000, and prices go up to $3.355 million for a 1,863-square-foot three-bedroom with a setback terrace.

“Our work was really about creating a distinctive way to live on Fifth Avenue,” says Kikoski of his design of 1280 Fifth Ave., which shares the address of the Museum for African Art, set to open next year.

Even the troubled Lotta development on Adam Clayton Powell, which went off the market to become a youth hostel back when things fell apart in 2008, is returning as condos this month. The 35 units should be priced around $500 per square foot, says broker Gilad Azaria of Prudential Douglas Elliman.

And one shouldn’t forget the 44 condos atop the new Aloft hotel on Frederick Douglass Boulevard. They plan to start selling this month, with prices from $300,000 for a 513-square-foot studio to $1.03 million for a 1,758-square-foot three-bedroom.

And many Harlem developers have been sweetening the deal. For example, 5th on the Park, which has been on the market since 2007, has been doing special promotions in which it’s snipped more than $100,000 off certain apartments and given another $10,000 off at contract signing (the promotion will be ending this Sunday).

Though nearly every Harlem building on the market is reporting an increase of foot traffic, there is still “a big gulf between buyers’ views of how soft they think prices will be and developers’ [views],” says Justin Hieggelke, a sales agent with TREGNY. “It takes more negotiating to get both parties to agree.”

One promising sign for Harlem overall is the mini-renaissance that has taken place on Frederick Douglass Boulevard. New restaurants and grocery stores like Best Yet Market have sprung up to serve the residents, anticipated in the hundreds, of new units along the street, which include the Aloft hotel and condo, 2280 FDB, the Douglass, the Parc Standard and the Livmor.

“There are new developments on every block,” says Lucille Chung, who closed on a 1,226-square-foot two-bedroom at the Livmor with her husband, Alessio Bax, for $675,000 in July. “You can’t tell there’s a recession here.”

“I think the time was right for me, financially and professionally,” says Maryann Riordan, who just put an offer on a nearly 1,300-square-foot one-bedroom at Savoy West on Lenox Avenue three blocks from her practice, Harlem Dental Associates, with Halstead broker Danni Tyson.

“I think prices were about where I expected,” says Riordan. “I wasn’t quite ready, but when I looked I thought, ‘OK, this is a good deal.’”

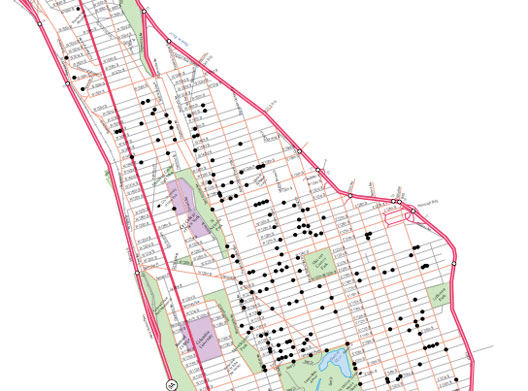

Additionally below is a summary of some of the hottest bets in Harlem now.

The Lore 261 W. 112th St.

1280 5th Ave. / Museum for African Art

Lotta 1961 Adam Clayton Powell Blvd.

5th on the Park 1485 Fifth Ave.

Aloft Hotel 2300 Frederick Douglass Blvd.

Madera 18 W. 129th St.

Odell Clark Condo II 108 W. 138th St.

Savoy West 555 Lenox Ave.

Odell Clark Condo I 2373 Adam Clayon Powell Blvd.

PS90 220 W. 148th St.

Great article! I can read it over and over…

Wonderful! I wish I had some extra ca$h.

Buyers in Harlem are basically disregarding concerns about a double dip in the housing market since they view their recent condominium buys as long term buy and holds, not short term flips. The ability to count on rising home values is surely safer with a 10-20 year time horizon than a 3-5 year horizon. Our team at Shimon’s Market Watch reviewed the Post article as well as gave an overview on national housing sales trends. We’d love to hear your feedback on the post as well: http://shimonsmarketwatch.com/2010/09/12/state-of-the-housing-market-nationally-in-harlem/